Much influential research on the relation between economic growth and the income of the poor has relied on the unstated assumption that positive and negative growth rates are equivalent in their effect on the poor. As I show in the CSAE Working Paper “Breaking Up The Relationship – Dichotomous Effects of Positive and Negative Growth on the Income of the Poor”, this assumption is easily refuted. Positive and negative growth rates correlate differently with the income growth of the poor. This finding becomes all the more powerful as it is produced using the same data and the same methodology, cross-country regressions, as one of the most influential papers based on the assumption that the effect is equal: “Growth is Good for the Poor” by Dollar and Kraay (2002). In this blog post, I would like to discuss not only the results of my paper but also how they reflect on cross-country regressions as a research tool and guideline for policy.

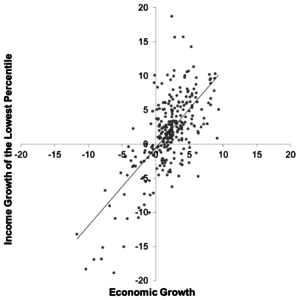

“Growth is Good for the Poor” by Dollar and Kraay (2002) established a one-to-one relationship between economic growth and the income growth of the poor. This implies that the poorest quintile in a country benefit to the same extent from economic growth as every other income segment of society. According to the authors, the rate of economic growth of a country over five years and the growth rate of the income of the poorest quintile of the country’s population are equal on average. Below is a replication of their central scatter plot. It shows a panel of 92 countries over four decades. The compilation of this data set alone was a noteworthy contribution of the authors. Along the 45° line, an increase in a country’s growth rate of one percentage point coincides with a one percentage point increase in the income growth rate of the poor. The authors fail to reject the hypothesis that the regression line’s coefficient is indeed one.

The notion that growth benefits all members of society alike quickly gained traction and remains influential to this day. The Dollar and Kraay (2002) paper has an impressive track record. With over 4,500 citations on Google Scholar and positioned roughly among the top 0.02% of RePEc IDEAS research items, the paper has left its mark (I heard reference to it at last year’s CSAE Conference as well). For the World Bank, findings like this meant that its focus of growth promotion was sufficient to fulfill its mandate of the reduction of poverty. It has even trickled all the way down into introductory development economics text books. Their result is simple but compelling. Neither the original nor my paper use particularly involved econometric methods. It is the simplicity of the original result that made it so appealing – as well as catchy – and the simplicity of the critique I bring forward that, as I hope, makes it hard to ignore. While the strength of my paper is pointing out flaws using the original data and methodology, this means that my paper inherits the flaws of cross-country regressions. I state my estimated results regardless – to be consumed with a pinch of salt – to counter the catchiness of a one-to-one growth relationship that “Growth is Good for the Poor” has so skillfully created. Or, if nothing else, as ammunition for the next time you stumble into a cross-country regression seminar.

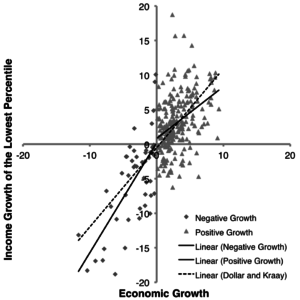

In my paper, I estimate the coefficient to correspond to around 0.75 percentage points income growth for the poor for every 1 percentage point of economic growth, while the effect of negative growth is found to be as high as 1.6 percentage points. While the statistical significance of the difference between my findings and the original is beyond doubt, it is the economic significance that is striking. The figure below illustrates the extent to which the poor are estimated to be worse off, both under positive and negative growth rates, than what the authors claimed to have found. To be clear, even when approaching this result in the same mind set as Dollar and Kraay did, this does not mean that growth is bad for the poor. It is simply not as good as they thought (though significantly less so). The correlational evidence that I offer suggests that especially the starkly negative growth rates of long-lasting recessions are detrimental for the poor. In this light, radical liberalization and deregulation that promise high positive growth rates at the cost of an increased risk of volatility and recession should be viewed with much greater caution than if the Dollar and Kraay (2002) result holds. I thereby refute the assumption of homogeneity in the relationship between the growth rates. The conventional wisdom that the poor benefit as much from growth as everybody else is losing ground – and with it the research methodology that brought it about.

There are three fundamental flaws in using cross-country regressions as a research tool in development economics. First, causality is tremendously hard to establish. Second, the estimates hardly ever translate into actionable policy. Third, estimation results can be very fragile. “Growth is Good for the Poor” illustrates all three of these flaws. The authors’ analysis is purely correlational as they themselves admit. Even if we take their results (or mine for that matter) at face value, they will not offer us much insight into how to alleviate poverty. The variance around the 45° line (or whatever shape the relationship may have) is simply too large for a government or development actor to base its poverty alleviation policy on. Cross-country regressions also cannot tell us how poor people benefit from growth. Finally, and this is where my paper comes in, modest alterations to the regression specification turn the narrative of growth being equally good for you no matter where you are in the income distribution on its head. My take-away from working on this topic is that cross-country regressions are certainly interesting for preliminary analyses. They can provide new research ideas as well as catchy facts to start a conference presentation. To guide policy-making, they prove to be a bit thin.

I would like to thank Thomas Ziesemer for his support in making this project happen and Simon Quinn for an enlightening discussion that put my thoughts on this in order and context.

References